As Tax Day approaches, the annual deadline brings a sense of apprehension for taxpayers in the United States. Following weeks of navigating through paperwork and crunching numbers, the culmination of this process is often marked by heightened stress.

By mid-February, more than 25.5 million taxpayers had already submitted their returns, resulting in an average refund of $1,741. For many consumers, this presents an opportunity to eagerly allocate funds toward products and services they hold dear.

The period leading up to and following Tax Day emerges as an opportune moment for online businesses to connect with their targeted customers through enticing campaigns and offers.

This article will help you understand more about Tax Day, reveal shopping patterns in 2024, and provide you with four tax season marketing ideas to effectively engage potential customers.

Understanding Tax Day and the Dynamics of Tax Refunds

1. What Does Tax Day Mean?

Tax Day refers to the ultimate deadline for submitting individual federal tax returns and settling tax payments. Typically occurring on April 15 each year in the United States, if this date falls on a weekend or holiday, it is observed on the subsequent business day. In 2024, Tax Day falls on April 15.

Upon filing their taxes, taxpayers often receive refunds, allowing them the flexibility to use the funds as they see fit. Naturally, this may lead to some of your customers being prepared to engage in shopping activities!

2. How Tax Refunds Impact Consumer Spending

With tax refunds, some taxpayers choose to save, invest, or settle debts, such as credit card balances. Others eagerly anticipate the opportunity to indulge in spending, either on long-desired purchases or simply for the joy of shopping.

Source: CNBC

Source: CNBC

According to Bankrate's findings on spending patterns for the 2024 tax day season, the dominant responses for all generations, except Gen Z, include saving and debt reduction. Interestingly, Gen Z expresses a preference for investing over debt repayment.

Approximately 20% of taxpayers plan to allocate their funds towards enjoyable expenses like vacations, home improvements, and retail indulgences, while 11% intend to address day-to-day expenses.

Although a significant portion of tax refunds may not be directed towards shopping this year, with over 30% earmarked for various areas mentioned above, this presents a valuable opportunity for online stores.

As an online merchant preparing for the tax season, consider implementing these straightforward tax season marketing ideas to potentially boost sales:

- Elevate your website to enhance the overall shopping experience.

- Optimize SEO strategies specifically tailored for the tax season to maximize online visibility.

- Introduce Smart Discounts to incentivize increased purchases.

- Use email marketing as a powerful tool to engage with customers and capitalize on the tax season's unique opportunities.

Tax Marketing Ideas to Ready Your Business for Tax Season

1. Enhancing Your Website: A Crucial Step for Tax Season Readiness

The arrival of tax season results in a substantial uptick in website traffic. To ensure a seamless experience for potential clients and reduce any potential frustration, optimizing your website is paramount for your tax season marketing efforts. Here's a comprehensive approach:

- Speed Enhancement

A slow-loading website can result in missed opportunities and a negative initial impression during the tax season.

Invest in speed optimization techniques, including image compression, caching, and a reliable hosting plan. More than half of mobile users, approximately 53%, are likely to abandon a webpage if it exceeds a three-second loading time. Therefore, aim for a website that loads in less than 3 seconds to guarantee an optimal user experience.

- Streamlined Navigation

Customers often seek specific information promptly. Implement the following features to facilitate quick and efficient navigation:

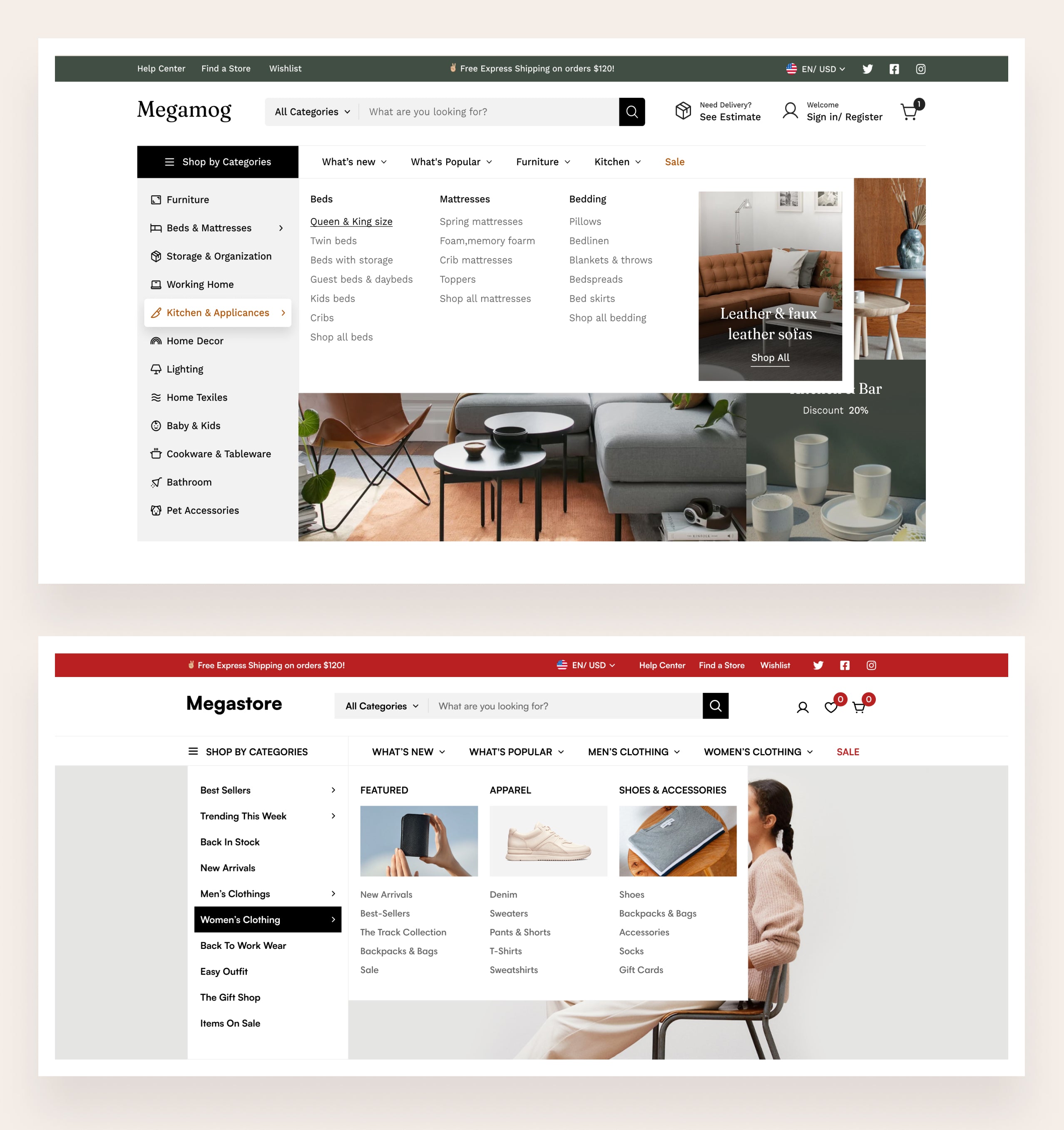

- Mega Menus: These expandable menus categorize your products, collections, FAQs, and other resources in a user-friendly manner. You can embed tax season collections in your mega menu to attract attention right away when visitors land on your website.

Effortlessly create an impressive mega menu using Megamog

For a seamless design of an elegant mega menu, explore the possibilities offered by the Megamog Shopify theme.

Specifically designed for stores with extensive product ranges, this theme facilitates the quick and easy development of a sophisticated mega menu in just a few minutes.

Megamog's mega menu brings a polished and well-organized aesthetic to your store, even when managing numerous categories and subcategories.

Learn how to add a mega menu to your Shopify store.

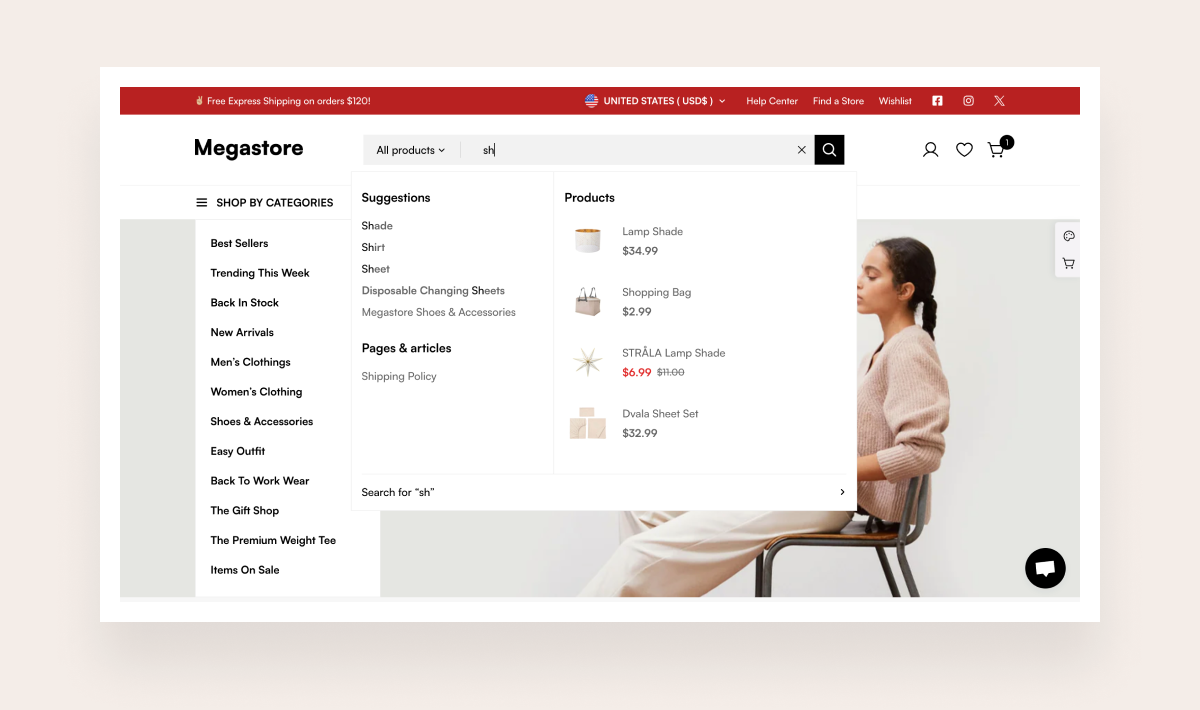

- Advanced Search: Enable users to search by keywords or filter by product/ service type, facilitating easy access to the information they require.

Enhance your product search journey using Megamog

Megamog Search provides a quick and effective way to finely adjust product catalogs or website content. Predictive search, also referred to as search suggestions, presents recommended results in real-time as you type.

This feature aids customers in refining their search without being redirected to a separate results page, allowing them to swiftly navigate your store by instantly viewing top results for suggested search terms, products, collections, and more.

Explore further details about Megamog's search settings.

2. SEO Optimization Tailored for Tax Season to Maximize Visibility

Search engine optimization, commonly known as SEO, plays a pivotal role in reaching a broad digital clientele. The effectiveness of your SEO content optimization and strategy directly influences the ranking of your website on prominent search engines like Google.

A higher ranking positions your website closer to the top of search results, ideally on the first page. Here's a guide on how to distinguish your online presence with SEO tailored specifically for tax season marketing:

- Optimize Headlines and Content

When initiating a "Tax Day Sale" promotion in your store, leverage keyword research tools such as Ahrefs, Semrush, or Google Keyword Planner to identify relevant keywords for incorporation into your headlines. This approach enhances the visibility of your promotion.

Additionally, consider keeping the promotion active for an extended period to cater to shoppers who complete their taxes later than others. Although it's challenging to accommodate every individual, introducing Tax Day sales for one to two weeks in April can be effective. Alternatively, you have the flexibility to extend the promotions for the entire month according to your preferences.

- Establish Targeted Pages for Tax Season Sales

Thoughtfully curate a specific collection of your current products exclusively for the tax season, and craft a dedicated page to showcase them. Additionally, consider generating new product pages to introduce additional items tailored for the tax season.

This specialized approach aims to create a concentrated and purposeful shopping environment, simplifying the overall shopping experience for visitors.

Select products tailored to customers' shopping preferences for the 2024 tax refund season, including items for home improvement, apparel, groceries, daily necessities, or vacations.

To further amplify the visibility of your tax season offerings, ensure that you optimize the individual product pages. Incorporate pertinent tax season keywords, identified through thorough research, into the product descriptions, titles, meta tags, and product URLs. This meticulous optimization strategy enhances the likelihood of your products appearing prominently in search engine results.

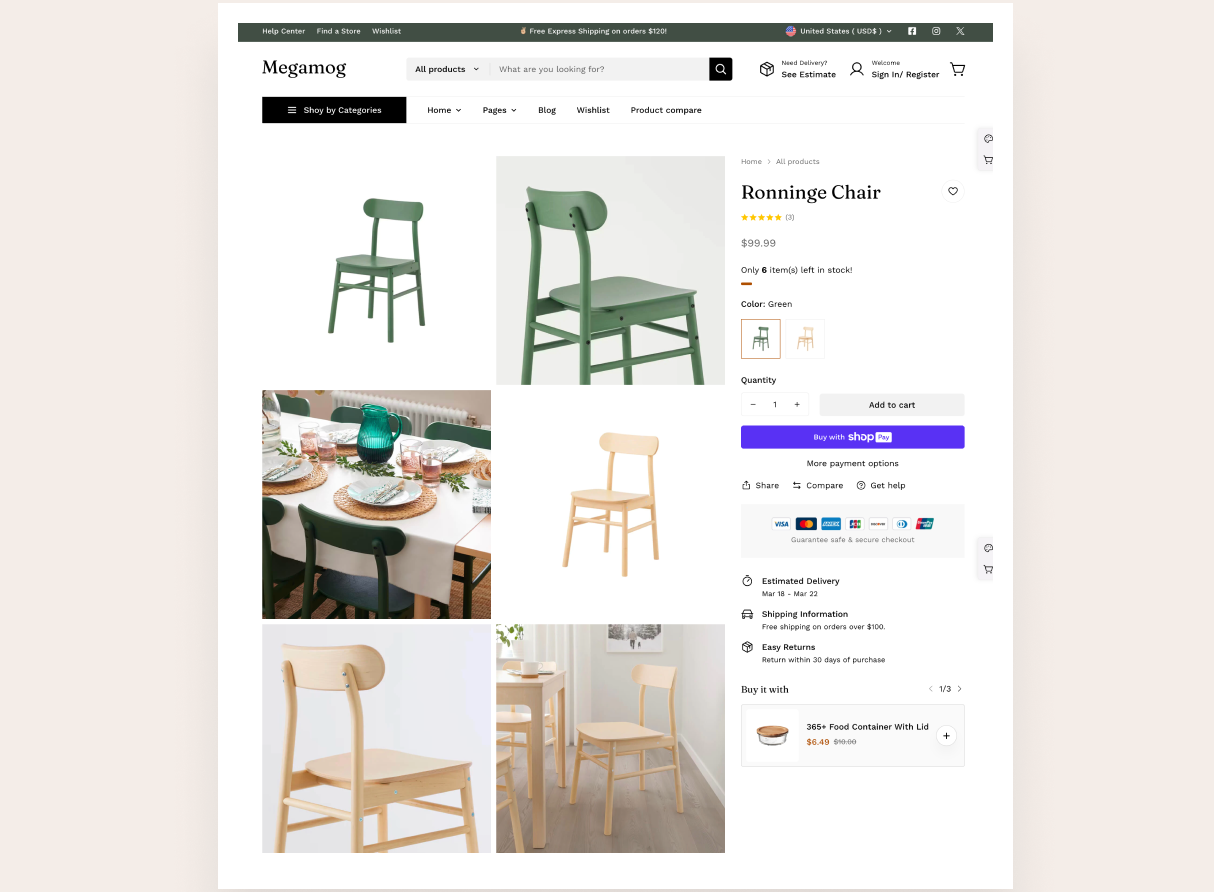

Effortlessly craft professional and stunning pages with Megamog

Explore 5 impressive ready-to-use demos, ranging from a mega pet store to furniture, hobbies, and even groceries, unlocking boundless possibilities.

Whether you aim to construct a dedicated collection page or design captivating new product pages, Megamog provides limitless customizable options for you.

Source: Megamog Demo Stores

Source: Megamog Demo Stores

3. Introducing Smart Discounts

During tax season, individuals become particularly mindful of their finances, making it an opportune time for strategic discounting.

A well-crafted discount strategy can serve as a powerful tool for tax season marketing ideas, capturing the attention of your target customers with enticing promotions, particularly when their focus is on financial matters:

- Implement Coupon Codes: An effective way to provide discounts for your Tax Day campaign is by introducing coupon codes. Assign a meaningful name to the code, such as TAXDAY24, and distribute it to customers through various channels, including social media, email newsletters, or other platforms.

Craft your message to convey the benefit, for example, "10% off with code TAXDAY2023 at checkout!".

Make sure to reach out to new customers by prominently featuring the code on your website, possibly through a banner at the top of the page. You can also consider designing an eye-catching image banner with a captivating background and an enticing call-to-action (CTA).

Toolup offers a 10% deduction on any regular-priced item on Tax Day with the coupon code TD10 via email newsletters.

- Offer Bonus Reward Points: This turns the campaign into a long-lasting rewards experience, prompting customers to look forward to using their earned bonus points in the future. As participation in the program necessitates shoppers to register on your website, the bonus points initiative not only enhances customer engagement but also stimulates more registrations. This, in turn, simplifies tracking and marketing to your customer base.

4. Leveraging Email Marketing to Connect with Customers During the Tax Season

Email marketing remains an exceptionally effective and widely embraced digital marketing method.

Marketers consistently witness impressive outcomes from email campaigns, boasting a remarkable return on investment (ROI) of 4200%, generating $42 for every $1 spent. Tax season is a great opportunity to connect with online shoppers through email marketing.

Here are some innovative ideas for your tax season email marketing campaign:

- Promote Discounts Effectively

Leveraging email marketing for tax season marketing ideas to promote discounts and special offers has the potential to enhance customer engagement by establishing a direct and effective communication channel between businesses and their customers.

Don't let tax season discounts go unnoticed! Use email marketing to directly reach your customer base:

- Targeted Offers: Segment your email list based on past purchases or interests. This enables you to send more relevant and personalized emails to each group, significantly improving your open rates and click-through rates (CTRs).

- Compelling Subject Lines: Capture attention with clear, benefit-driven subject lines such as "Beat the Deadline & Save! Tax Season Deals Inside" or "Maximize Your Refund: Exclusive Discounts on [Product Category]."

- Clear Calls to Action: Make it easy for customers to act. Include strong CTAs like "Shop Tax Essentials Now" or "Claim Your Tax Season Discount" with a direct link to your product pages.

Bertucci’s leveraged email marketing to present an enticing 18% discount on both dine-in and takeout orders, using the code TAXDAY2023. The subject line, "Don't let taxes get you down - save 18% today!" urges customers to act promptly. To intensify the sense of urgency, the discount was exclusively applicable for orders placed on April 18th.

Bertucci’s leveraged email marketing to present an enticing 18% discount on both dine-in and takeout orders, using the code TAXDAY2023. The subject line, "Don't let taxes get you down - save 18% today!" urges customers to act promptly. To intensify the sense of urgency, the discount was exclusively applicable for orders placed on April 18th.

- Introduce the Referral Program and Its Incentives

Recognizing the shared interest in tax day promotions, leverage motivation techniques to attract both existing and new customers to your business.

Announce your referral program through emails, offering incentives to both the referrer and the referred customers. The incentives can include discount codes on your products or collections for tax season, or gift cards with a specific value.

Alternatively, you can provide product discounts to brand new customers and reward those who make referrals with $45 gift cards.

Pro tip: If you encounter difficulties starting an affiliate program for your online store, consider taking a few minutes to explore UpPromote: Affiliate Marketing. This Shopify app is specifically designed to help online businesses establish and manage effective affiliate campaigns.

With UpPromote's user-friendly interface, you can easily create a polished affiliate program and seamlessly connect with potential affiliates.

Wrapping up

As Tax Day approaches, online businesses have a chance to flourish by adopting the targeted tax season marketing ideas mentioned above.

The article underscores pivotal strategies like optimizing website functionality, customizing SEO for tax season visibility, introducing smart discounts, and harnessing email marketing.

Through crafting a seamless online experience, providing attractive incentives, and establishing robust communication channels, businesses can elevate customer engagement and boost sales in this pivotal period.

Now, it's time to gear up and ready your business to capitalize on the distinctive opportunities that Tax Day offers, securing a prosperous and influential online presence.